Alas, my trusty Japanese car is turning 10 years old and i have decided to renew its COE as it still runs smoothly and a check with my trusted mechanic says that it is in perfect condition for 10 extra years. Base on the COE chart below, i was hoping that the cost of COE would go down since 2006 had the highest COE quota given out and that more people would deregister in 2016. It didn't go down much to my utter dismay.

Who would have thought that Grab and Uber would buy so many cars in such a lackluster economic climate!

Anyway, from what i gathered, here are some findings i would like to share. In sharing, i hope to receive constructive feedback in case my thinking is not optimal or plain wrong.

1) The best times to renew COE

The best time to renew is after the third wednesday of the prior month to your deregistration date, depending on the 2 scenarios below.

Take for example my scenario.

My car is to be deregistered on 5 October 2016. The September PQP is $53339.

If i see that the COE bidding for the 1st and 3rd wednesday of September is lower than $53339, i can be absolutely certain that the October PQP will be lower than $53339. I will then renew my car in October before 5 October.

If i see that the COE bidding for the 1st and 3rd wednesday of September is higher than $53339, i will renew it before 1 October.

In considering the above, take note that if you renew your COE on the deregistration month, your new COE starts the day after your deregistration date. If you renew your COE anytime before your deregistration month, your new COE starts from the 1st of the next month.

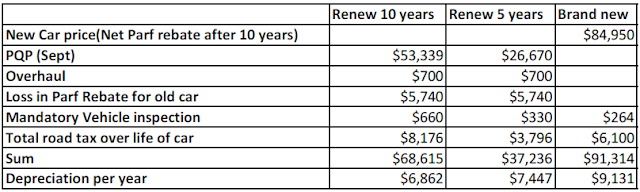

2) Renewing in CASH ( No loan) for a 10 year period is generally better than a 5 year period at this point in time

The disadvantage of renewing for a 10 year period is the high upfront cash you have to fork out. It gets stuck with the government until you choose to deregister your car and get back the prorated unused portion of the COE.

However, renewing for a 10 year period gives you an option to deregister your car anytime while awaiting for the COE to drop drastically. You can renew for another 10 years, in blocks of 10, indefinitely. If you renew only for 5 years, you can still deregister anytime, BUT you are compelled to deregister on the 5th year and can no longer renew .What if the COE within the 5 years is still super high?

Furthermore, looking at the COE quota cycle currently, by renewing COE for 5 years now, one is caught at the wrong part of the COE quota cycle as 2011 had very few COE quotas.

Other advantages include amortising your foregone PARF over a period of 10 years instead of 5 years. Take note that when renewing COE, road tax increases 10% every year till the 5th year before remaining at 150% of the road tax for the remaining years.

3) Japanese cars is generally more worth it to renew than Continental car, unless you are driving a classic continental car which appreciates in value

Japanese cars generally have lower PARF forgone. Also, Japanese cars generally have chock full of available parts, not to mention being more reliable.

For my case, my car depreciation per year if i were to renew for 10 years is about $6000 per year, compared with the minimum depreciation of $9000 per year if i were to buy a brand new car.

Sorry.I can't help it. There is a saying that the more we mention about something, it comes true. I'm hoping for the stock market to fall.

|

| The car i cant' afford nor want nor desire |